FirstCry - A Bet on Startup Potential and Modern Retail in India

- Jinal Sanghavi

- Jun 29, 2025

- 7 min read

Updated: Aug 13, 2025

Did you know that Supam Maheshwari, the unflashy founder of Firstcry, child of parent company Brainbees that listed in Aug-24 is the founder of three unicorns (Brainbees, Xpressbees and Globalbees) and a sharp personality contrast to the more extroverted other Ola founder with 3 unicorns promoted by him. Fun fact: all his startups have "bees" at the end because bees are extremely hardworking and also make a lot of honey (or money).

I have been a Firstcry customer myself for close to four years now and reaped many discount benefits of the Club membership as a mom. It's definitely a market leader in the childcare space in India and has won the admiration of even the likes of Anand Mahindra, who sold its stake in Mom & Me to Firstcry rather than compete with it.

In this (slightly long) post, I analyse the business model, its strong growth potential in India and Middle East, its improving unit economics and take a leaf from valuation guru Aswath Damodaran's book to value the company at ₹410, close to its IPO price band but much lower than currently trending at ₹669. Hence, while I don't think this stock is a good investment in the near term, I look forward to being corrected.

--

On Aug 13th, Firstcry brand owned parent company Brainbees Solution Ltd made a strong IPO listing, subscribed 12.2x times and listed at a premium of ~40% to the issue price of ₹465 per share.

About Firstcry: Founded in 2010, the company is the market leader and an omni-channel retailer (both online and offline stores) for baby and kids' products in India, UAE and Saudi Arabia. The range of products, including clothing, toys, diapers, baby gear, and more, focused on serving mothers and children.

As an active customer myself since the last four years and a sucker for the competitive discounts through Firstcry Club membership for my monthly refills of diapers, Sebamed body washes and so much more needed to raise an infant today, I am excited by this response and curious about valuing this company.

Why is this market debut consequential? 1) Market Endorsement for New Retail Companies in India: Though Nykaa's stock market performance has been a struggle, currently price trending at ₹193 vs its market high of ₹400+ in 2021, this is market endorsement that there's high potential in the coming of age in Indian retail space and vertical marketplaces. There's room for more of these companies in India. 2) Reflection of the Potential in Driving Economic Value vs Current Actuals: In FY24, the company reported net sales and EBITDA of ₹6,480 crore and ₹70.5 crore, respectively, while it posted a net loss of ₹321.5 crore, which translated to a 15% increase in operating revenue with a 34% reduction in loss, indicating that the company's fundamentals were moving in the right direction and markets are ok with this performance.

Setting the Stage

Firstcry platform launched in India in 2010 by Supam Maheshwari, the non-flashy second time founder with his cofounder Amitava Saha, after they sold Brainvisa Technologies, one of the earliest eLearning solutions, in 2007 to US company Indecomm for $25mn. He studied mechanical engineering from Delhi College of Engineering followed by an MBA from IIM Ahmedabad and is based out of relatively quieter city of Pune compared to the hustling hubs of Mumbai, Delhi or Bangalore. The goal of the company was to create a one-stop destination for parenting needs across commerce, content, community engagement, and education. From very early on, the company decided to make its offline bet in addition to online retail, setting up its store in Gujarat a few months after launch, a phenomenon that increasingly D2C companies and marketplaces such as Sugar, Lenskart and Nykaa gradually evolved to, in order to maintain sustainable growth.

So, How does Firstcry make money?

Unfortunately, the DRHP is not clear on the split across the different verticals but here's my attempt to break this down.

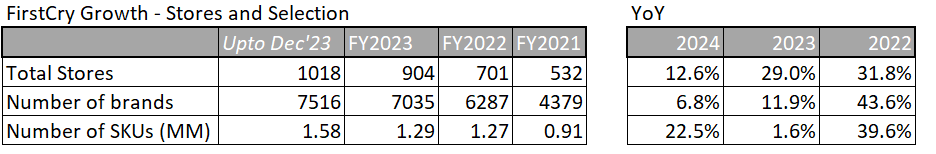

1.Fees: The bulk of the revenues come from the transactions on its platform, as the company keeps a percentage of the total purchase value for itself from prominent third-party Indian brands, global brands, and its home brands, most notably "Babyhug". While commissions vary across brands and product types, it remains about 30-35% of gross order value as per the financials. While there was a drop in gross margin in FY23 from previous Covid tailwinds by ~440bps, it is encouraging to see the recovery in the past year as per the DRHP back to ~35%. The company has a multi-channel footprint: ~1018 modern stores (with 1.76 million+ sq ft retail space) across India and its mobile application in India has been downloaded more than 104 million times, as at June 30, 2023.

2. Subscriptions: Firstcry club membership launched in 2021, is available for ~₹399 for 3 months and has been one of the key drivers in expanding the annual unique transacting customers’ base over the years (from 5.38 million in Mar'21 to 8.8 million as of Dec'23) and increasing the AOV at a health rate from ~₹2.1K to ~₹2.6K. Accordingly, the company states in its DRHP that they will continue to invest in increasing brand awareness (by continuing marketing, business promotion, and FirstCry Club activities) and brand salience (by carefully expanding its assortment of products and SKUs, and maintaining the FirstCry parenting community).

3. Advertising: Brands also spend more on advertising, based upon customer visits and resetting revenues, to get additional visibility. This has been on a steady increase (listed under other operating revenue), increasing from ~₹44 crore in FY21 to ~₹78 crores (+78% YoY)

4. International expansion: The company expanded internationally in select markets, establishing a presence in UAE and Kingdom of Saudi Arabia (KSA) in 2019 and 2022 respectively, to replicate the India playbook. The DRHP reports that the company is the largest specialist online Mothers', Babies' and Kids' Product retail platforms in UAE, in terms of GMV, for the year ending December 2022. Further, in KSA, they are the largest online-first Mothers’, Babies’ and Kids’ product focused retail platform. This was a well-thought out global expansion. Initially, the company's board and key investors pitched Indonesia, given it is perceived to be similar to India. Maheshwari spent days in the country and decided against it, citing high competitiveness, and instead pitched the Middle East.

5. Other investments: The company has also set up seed investments, most prominently in 1) Preschools called Firstcry Intellitots, which as fanchisee operated preschools for children between 1 to 6 years, and where it received revenue from royalty and sales of student kit to franchisee schools. As of Jun'23, it had 180 preschools across 91 cities in India; 2) Globalbees, its subsidiary, which targets D2C brands across categories such as beauty, personal care, home, kitchen, food and lifestyle to scale up e-commerce operations. Since inception, Globalbees has invested in about 26 companies and has over 55 brands in its portfolio.

In conjunction with the data from the Redseer report cited in the DRHP and other market data, here are some key trends:

1.FirstyCry’s current total addressable market is ~₹3,443 billion (approximately US$43 billion) in 2022 which is expected to grow at CAGR of ~12% to ~₹6,060 billion (approximately US$76 billion) by 2027.

2. India is among the youngest nations in the world, with a median age of ~28 years, resulting in a young and tech-savvy population with a higher propensity to adopt new trends. Population aged 0-12 years account for ~22% of the India’s population making India home to the largest population of children in the world.

3. Another report by Data Bridge Market Research supports the upward growth trend of the mother and baby care market and further states that due to rising per capita expenditure on children and greater awareness of child health and cleanliness, “baby cosmetic and toiletries” leads the product sector of the baby care goods market.

4. Despite India having one of the highest birth rates globally, spending on childcare products in India remains a fraction of that in the developed world. In 2022, the average expenditure per child in India was ₹8,000, compared to ₹46,000 in China and ₹24.1 lakh in the US. With changing macroeconomic conditions and rising dual incomes, the average spend of ₹8,000 per child in India is expected to double by 2027.

5. About 80 per cent of the childcare products market is unorganised. In the organised sector, the market includes horizontal and vertical players. Horizontal online platforms include Amazon, Flipkart, and Meesho. Vertical online platforms comprise Hopscotch, Myntra, and Ajio. Firstcry operates as a multi-channel retailing platform.

The Valuation

I enjoy building the numbers with the narrative, famously made popular by NYU Prof Aswath Damodaran. Modifying his Zomato valuation from 2021 to reflect FirstCry/Brainbee's financials and my growth narrative for FirstCry basis some key assumption - 1) Solid growth in childcare, reaching about $60bn combined with 2) exponential high growth focused on the first five years, 3) strong economies of scale experience as a market leader in this vertical childcare sector and 4) expected big investments in technology and some large acquisitions to drive inorganic growth, the valuation I get for this company is close to the market price projected at ₹410 but much lower than currently trending at ₹669.

Basis this already baked in goodness due to the strong market growth, improving unit economics and projected economies of scale as a market leader, I do not think the value of the stock for Firstcry will further go up, unless something big changes in the business model in the near future.

In conclusion, sharing a

dated interview by Supam from eleven years ago, where much of his vision is now realised today.

Comments