Analysing Meesho - A Business Built for Bharat

- Nov 27, 2025

- 12 min read

Updated: Dec 3, 2025

Early 2010s, India saw a bunch of horizontal marketplaces (Amazon, Flipkart, Paytm Mall, Snapdeal, etc.). Then, we saw vertical marketplaces like Nykaa, Firstcry, Myntra, etc. The 2020s are interesting: we're seeing two forms of e-commerce - one value focused like Meesho and the other, convenience focused with rise of Blinkit, Instamart, Zepto.

Meesho is set to IPO in Dec-25 and its DRHP was public in October, full of rich insights. So, I thought it only fair to deep dive on this company that has quickly built a sizeable business by analyzing publicly available information - interviews by cofounders Vidit & Sanjeev, it's early Series A pitch deck from 2017, last year's annual report and most recently filed DRHP.

The Meesho Story

Meesho has undergone a series of pivots in its 10 year journey. Cofounders Vidit and Sanjeev were classmates at IIT Delhi who were hit by the startup bug after a few years working for companies. In 2015, their first venture "Fashnear" was hyperlocal delivery for fashion, almost like Swiggy. However, they faced many challenges - fashion was typically not an immediate need, inventory availability was a challenge in nearby stores. So they shut down the business to focus on building shopping tools for small businesses to help them sell better i.e. Meri Shop, shortened to "Meesho".

The Problem: In India, 90% of commerce takes place in small, unbranded, mom-and-pop shops. Entrepreneurial demand exists but most people lack the capital to start a store. Meesho gave such individuals their first real opportunity to operate a business by democratizing digital commerce and removing barriers particularly for those who couldn't access capital or formal retail infrastructure.

It was around then that they got funded by Y-Combinator. Check out this fantastic interview with YC from Meesho's early days, where Vidit talks about tech trends that enabled Meesho (rise of WhatsApp and social media, internet through Jio, UPI payments and trust deficit in India on brands online versus community members selling products). Fun Fact - they were one of the few companies that didn't get funding on YC's famed Demo Day. However, it built a culture of resilience and frugality in the company from the onset, benefits that show up today.

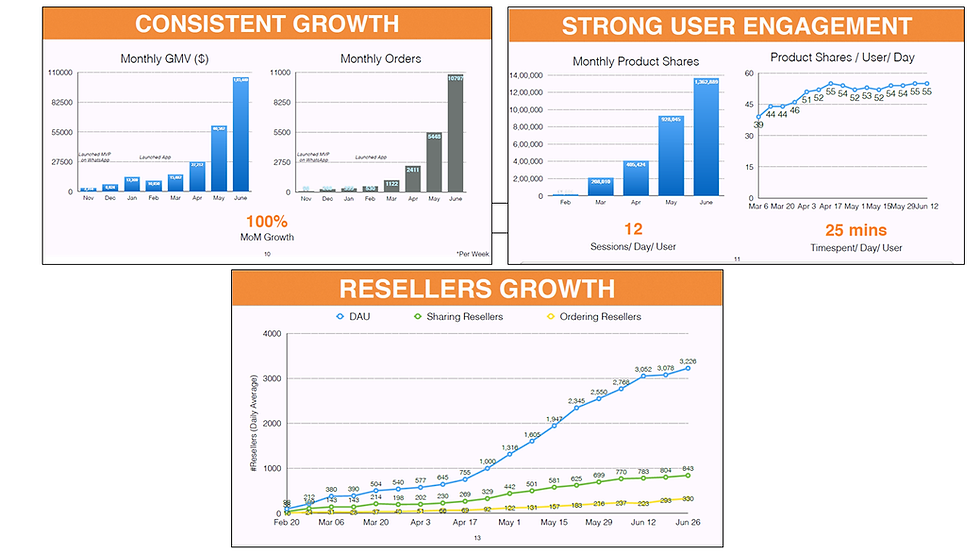

The Solution: Inspecting early customers, the founding team noticed tremendous love from housewives, who started their home boutiques on Meesho. It was secondary income and financial independence for them. And the monthly traction was spectacular - doubling product shares x sales every month. It gave birth to the reseller and social commerce model for Meesho. Small business and home entrepreneurs could now easily share catalogues of products through their WhatsApp or Facebook and earn commissions. This led to the Series A for Meesho - some slides below that show early traction (pitch deck here), rare for such early stage of a company built for a largely offline customer segment.

The model since has evolved, Meesho moved to the marketplace platform model in early 2021 driven by the tailwinds in the pandemic that pushed people to shop online in drones, when offline shops were largely closed. But at its core, even today the company remains laser focused on its value first promise and enabling ease of doing business for millions of small businesses and entrepreneurs, powering their growth to bring the next 500MM shoppers online. Its mission: Democratize internet commerce for everyone. By building a platform that is accessible and affordable, Meesho is empowering businesses of all sizes and serves a diverse customer base, whether a high-income urban shopper like me or a tier 4 city user. What sets Meesho apart - they are unilaterally focused on a wide assortment at lowest prices. They do not promise speed, even in an instant gratification world. And yet, they're doing very well, growing at ~30% YoY, because they provide a "different" kind of value to customers. Customer that they are willing to wait for 10-14 days for great deals.What sets Meesho apart - they are unilaterally focused on a wide assortment at lowest prices. They do not promise speed, even in an instant gratification world. And yet, they're doing very well, growing at ~30% YoY, because they provide a "different" kind of value to customers. Customer that they are willing to wait for 10-14 days for great deals.

From the FY24 annual report:

We believe everyone should have access to a wide range of products at the right price to meet their unique needs

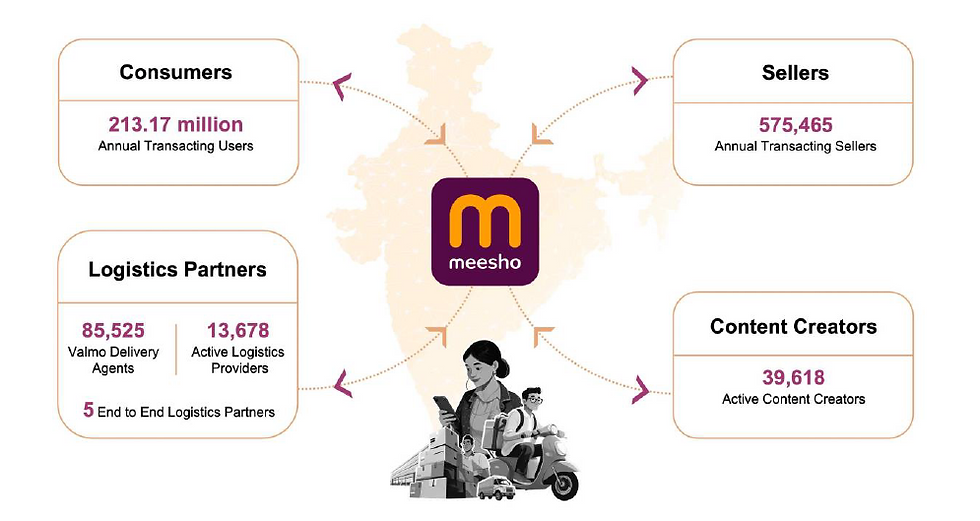

Today, Meesho is a marketplace with a strong focus on value-commerce and affordable products largely from Tier 2 and smaller towns in India, serving 213 million annual transacting users, processing ~2 billion orders annually and has a Gross Merchandise Value (GMV) run rate of about $6.2 billion for FY25. It operates an asset-light, zero-commission marketplace model that offers customers a large variety of low priced, largely unbranded products, in stark contrast to the rising wave of convenience focused full-stack quick commerce startups. Meesho's business model bends social selling and dropshipping, where resellers market products to buyers and purchase from Meesho’s supplier network, with Meesho handling logistics, product delivery, and customer support.

The Meesho Flywheel offering ‘Everyday Low Prices’

Meesho's value-focused ecommerce play works by connecting not three but four players: consumers, sellers, logistics partners, and content creators. This is made possible by providing a low-cost channel for sellers, which in turn allows them to offer a wide assortment of products at affordable prices to consumers.

Meesho then engages with unorganised logistics partners, encompassing first and last-mile delivery businesses, sorting centres, and truck operators, through Valmo to ensure cost efficient order fulfilment. Content creators on Meesho enhance product discovery and drive sales by sharing engaging content, with Instagram like reels, live commerce and more. About a month ago, Asymmetric podcast did a great deep dive on the company's four sided marketplace that is definitely worth a watch.

Value-first for the next millions of online shoppers, betting on unorganised retail

India’s retail market is expected to remain fragmented in terms of supply, with regional brands and unbranded products projected to drive more than 70% of the total retail spends. This reflects the trends in mature e-commerce markets such as China, which have proven models in the likes of Temu, Pinduoduo & TikTok Shop that value focused e-commerce has the ability to dominate e-commerce sector in the long term and in a sustainable way. The supply fragmentation led by regional brands and unbranded segments is prevalent across most prominent categories in India retail (except pharma, BPC, and electronics)- driven by diverse local preferences, price sensitivity, and complex, intermediary-heavy supply chains. Categories like Saree, Toys, Home Decor have high SKU fragmentation and a long-tail demand structure

The opportunity to bring online the next millions of shoppers

While the online shopper base has nearly doubled post-COVID, a sizable gap persists between India’s smartphone users and shoppers. As of 2025, India has ~70 Cr smartphone users, while the number of e-commerce shoppers stands at only 25 Cr, highlighting significant headroom for further e-commerce penetration. India's e-commerce shoppers represent 35% of internet users, below mature economies like the US (~88%) and large emerging economies such as China (~83%) and Indonesia (~52%), also indicating a headroom for increased e-commerce penetration.

The majority of new online shoppers are projected to come from tier 2+ cities. Despite the growing digital access and rising transaction volumes in Tier 2+ cities, e-commerce penetration remains low at ~4% in Fiscal 2025, compared to ~14% in Top-8 and Tier 1 cities. This section of Indian consumers prioritizes affordability over other purchase criteria (e.g. availability of specific brands, ease and speed of access etc.), across multitude of purchase use cases, given the relatively low per capita income (vs other large economies). This makes consumption in India highly price elastic when shopping online. Meesho is able to address this - giving lowest prices to customers by being asset-light: no inventory, no logistics infrastructure and charging 0 commissions to sellers, thereby reducing their cost of doing business on the platform

The high assortment width and depth at lowest prices are enabled through the following levers:

• Easy seller onboarding: Minimal profile requirements, allowing unbranded sellers to list products at scale

• Low platform and fulfilment costs enable favourable seller economics: Unbranded and regional sellers benefit from zero or low commissions. These cost efficiencies support better margin realisation for sellers and provide them with the flexibility to price products competitively

• Assortment freshness driven by seller diversity and data-led insights: Platform-driven insights on top-selling SKUs and emerging consumer demand patterns further enable sellers to optimize their assortments, ensuring freshness and relevance across lifestyle and discretionary categories.

• Logistics cost optimization: Distributed fulfilment models with tech-enabled orchestration to minimize cost per shipment. Valmo is Meesho’s asset-light logistics platform with no ownership or lease of physical infrastructure across the first-mile, mid-mile or last-mile, including pickup fleets, sorting hubs, line-haul assets, delivery networks, warehouses and dark stores, with all operations executed entirely through third-party or partnerled infrastructure. Valmo's average cost per shipment for a surface delivered shipment weighing 0.5-1kg is up to 12% lower than that of competitors

Investing in Discovery Led Content Commerce

Unlike search led commerce with high involvement in purchase, content commerce is built on relatability and low friction led by lower prices. Launched only in 2023, content commerce is a key focus area - Meesho's app highlights"Video finds" upfront on its app to incentivize shoppers to spend time scrolling, generating INR 946 crore in marketplace NMV (~3.2%) but rapidly growing, with 39k+ active content creators (TTM ended Jun-25).

Meesho has built its content commerce muscle by

• Video-first and content-led browsing: Immersive video formats that supports exploration-driven impulse engagement, particularly in categories which are discretionary - like home and kitchenware, and where visual presentation and usage context influence purchase.

• Trust through influencers and communities: Leveraging learnings from the erstwhile focus on housewives' boutiques, Meesho establishes trust through nano and micro influencer-led recommendations, peer validation, and social proof embedded within the community content.

• Social media-style curation drives relevance and repeat engagement. Mirroring social media consumption, influencer content and product listings are surfaced through algorithmic feeds based on user behaviour, interest signals, and past engagement.

Valmo (short for 'Value Mobility') - Masterful Logistics Orchestration

Valmo integrates third party logistics services providers, including first and last mile delivery businesses and individuals, sorting centres, truck operators to come together and fulfil orders by combining their resources and capabilities. Orders placed on Meesho are fulfilled either through (i) their proprietary and unique technology platform – “Valmo” which orchestrates a multi stage logistics network across multiple logistics partners, or (ii) end-to-end logistics partners such as Delhivery. By aggregating multiple logistics partners and their services on Valmo, the company unlocked business opportunities for e-commerce logistics for players who do not have end-to-end fulfilment capabilities. As of Jun-25, there were 13,678 Active Logistics Providers, five end-to-end logistics partners, and 85,525 Valmo Delivery Agents. Meesho's large order volumes help logistics partners optimise their existing assets and allows them to invest in future capacity for incremental earning opportunities.

Shipping income is the biggest source of operating revenue for Meesho. There are 2 different types of Shipping Income:

1. Forward Shipping income is a stream of revenue generated from shipping charges recovered from sellers upon successful delivery of goods - reflecting the logistical and operational costs associated with transporting goods to their destinations.

2. Return shipping income is a stream of revenue that is recovered from the seller in case the product is returned or exchanged by the end consumer.

In addition to shipping income, Meesho makes money via

Mall Fee for premium and D2C brands for "Meesho Mall" - a commission is charged as a percentage of the sale price for each successful transaction made through the mall platform

Advertisement revenue from the display of online advertisements which is run on the platform.

Return and RTO Assurance Program designed to offer sellers a way to manage and control their return percentages effectively by offering financial predictability and protection against unforeseen return-related expenses.

Discounts to Platform end consumers to promote transactions on its platform. F

Commission Income on an accrual basis over the period of the loan arrangement with non-banking financial companies (NBFCs), provided there is no significant uncertainty regarding its collectability.

At its core, Meesho has Bharat related investments in AI & Technology

In the DRHP, Meesho allocates significant real estate to the incubation of Meesho AI Labs: focused on deepening AI capabilities. For example, the team has built AI driven systems that personalise the shopping experience, such as optimising product rankings and tailoring recommendations. Meesho AI Labs has also worked on improving customer experience through vernacular voicebots, fulfilment and logistics planning, catalogue quality, pricing optimisation, and trust and safety. About 56% of Meesho's lean team of ~2000 employees are in Tech and Machine Learning + AI. While people doesn't always translate to outcomes, a 60% increase in ML + AI employees in the past year shows that the company means serious business in AI.

Meesho created their machine learning (“ML”) platform called “BharatMLStack” that addresses the challenges of cost, scale and latency, empowering a variety of ML use cases such as real time personalisation, geo-encoding, competitive pricing and automation. Whether on its AI blog or in interviews or in the DRHP, Meesho has been very vocal on the potential of AI to help drive costs further lower for customers and sellers. Currently, the execution is across

Personalisation: Meesho’s ranking system called “BharatML-RankEngine”, determines which products are shown, in what context, and to which consumers across all touchpoints of the app. The

LLMs interpret consumer queries, correct spelling errors, and rewrite them into more structured and standard forms for better compatibility with search retrieval models- a query such as “peele color ke kurte” will be rewritten as “yellow kurta”, “bal bottom pant girls jince” is corrected into “bell bottom pant girl jeans.”

Consumer support: Meesho provides AI-based consumer support solutions across ten Indian languages for handling consumer queries and problem resolution. As of Jun-25, ~60% of consumer queries were resolved through AI-based solutions.

Product listing and cataloguing: Sellers can create a catalogue of products live by uploading pictures clicked from their mobile phones, and Meesho's platform converts them into listing ready images. Using AI, it can also provide recommendations for product titles and descriptions.

Product recommendation and inventory tracking: Provides recommendations on best selling products to sellers and the seller’s panel on Meesho provides real time visibility on sales and inventory

Meesho's tech blog breaks down its approaches using AI and technology across topics like personalisation, Creative labs and scaling inference to help serves the other "Bharat" and is a great read.

Financial Highlights

Net Merchandise Value (NMV) grew 29% YoY to ₹29,988 crore in FY25, with Q1 FY26 showing an even more accelerated growth of 36% YoY, far higher than e-commerce growth rate in India at ~12% YoY in the same period. Revenue from operations were ₹9,389crore in FY25, a 23% YoY increase, with a revenue CAGR of 28% during FY23-FY25.

Meesho reported a restated net loss of ₹3,941 crore in FY25, significantly wider than ₹327 crore in FY24. However, this was largely from one-time exceptional items related to reverse-flipping (shifting domicile from US to India), corporate restructuring, and accelerated ESOP vesting. Excluding these exceptional items, the underlying operational loss was ₹108 crore in FY25 and hence there is a clear path to profitability for the company.

Most importantly, Meesho generated positive operating cash flow of ₹591 crore in FY25, marking a significant turnaround from negative ₹2,336 crore free cash flow in FY23! This was a conscious area of focus for the company - highlighted earlier in their annual report as the north-star metric of the business. "We believe that it truly and accurately depicts the health of a business, without the added complexity of ignoring different components of shareholder dilution or value creation." All of this topline and bottom line growth, while maintaining healthy growth in customers at 28% YoY to ~200 MM and sellers at 21% YoY to 500K+ unique sellers with at least one order on Meesho.

But what are the big risks to the business?

Being asset-light and a pureplay marketplace has its own limitations.

Valmo, as the technology infrastructure and not the owner, is limited by the number of logistics providers it can onboard and manage. The performance and reliability of Valmo is dependent on the logistics partner's onboarding, routing, tracking and payments. According to a special report by The Arc, Meesho's dependency on Valmo is unlikely to exceed 65-70%

Content commerce - is this a niche or a real thing? E-commerce in India, especially for the top 3 players, is slowing down to ~17% YoY between FY23 to FY25 (compared to ~30% YoY between FY20 and FY23), according to estimates quoted in this Mint report. Hence, the players look for new bets to speed up consumer spending and initial excitement around content commerce looks promising. Yet, livestream remains nascent in India, sustained participation is still a challenge (and hasn't scaled) and monetization models are still evolving.

Small-seller dependence also heightens risks of low-quality or counterfeit goods. Meesho has undertaken two key initiatives to address this - Project Suraksha and Project Viswas. Project Suraksha has pre-listing checking tools (Image Match, Logo Detection, Image OCR, Caption generation), manual reviews, keyword detection tools and a Suraksha list (brands and patterns for non-compliance). Other product quality initiatives include "M-Trusted" badge for high performing sellers, feed ranking logic prioritisation basis 'reliability' of listings and LLMs used to extract structured insights from customer reviews. While there have been routine social media posts claiming low quality items, this doesn't seem to have materially impacted the company's financials yet - at least saw no large liabilities related to infringements, brand litigation and copyright

A Key Callout is Meesho's User first Mindset

Through various Meesho documents and interviews, one thing that rings true is their user-first and seller-first obsession. In an interview, Vidit says - For an entrepreneur, the best thing is to solve a problem you face. The next best, solve for those who can't solve for themselves. Referring to housewives and small business that struggle to grow and gain financial independence. In the early days, the company had “We Hear You” townhall-style videos to communicate company updates that was shared not only internally but also with their resellers. This was much appreciated, and gave them an opportunity to share feedback on company plans and performance with their sellers. Even today, cofounder Vidit is on WhatsApp groups with Meesho sellers, which gives him real time feedback on any new product launches and the seller sentiment. One of the company's key values is - User 1st. Meesho has instituted a mechanism - “Listen or Die” initiative to ensure that every quarter, employees from across functions spend at least one day engaging with sellers, consumers and logistic partners. They then synthesize their findings with direct feedback, that acts as an input for the team's roadmap and priorities.

In summary, internet commerce in India is at an exciting junction, with disruptions across all models. Joel Modestus, a Director at Flipkart, recently share a great Internet Commerce report as a personal project, from which I have lifted this below slide as an apt summary for why Meesho not only works, but thrives!

Comments